missouri employer payroll tax calculator

Public employees exempt employees paycheck. Missouri Withholding Tax Multiply the.

We Solve Tax Problems Debt Relief Programs Tax Debt Irs Taxes

Employees Missouri taxable income by the applicable annual payroll period rate.

. This is a rate calculation based on the ratio between an employers average annual taxable payroll unemployment benefit charges against its account and taxes paid previously by the employer. The result is the employees annual Missouri withholding tax. Subtract any deductions and payroll taxes from the gross pay to get net pay.

Calculate your Missouri net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Missouri paycheck calculator. Dont want to calculate this by hand. Available at participating offices and if your employers participate in the W-2 Early Access SM program.

Here are the current Missouri tax brackets posted by the Missouri Department of Revenue. If an employer pays state taxes timely the 6 rate will be reduced by 54 and the employer will pay their federal UI tax at a rate of 6. 2022 Missouri Withholding Tax Formula.

All tax is. Begin at the lowest rate and accumulate the total withholding amount for each rate. If the state has an outstanding loan for 2 years and is unable to pay back the loan in full by November 10th of the second year the 6 rate will be reduced by only 51 changing the percentage an employer will pay their federal UI tax to 9.

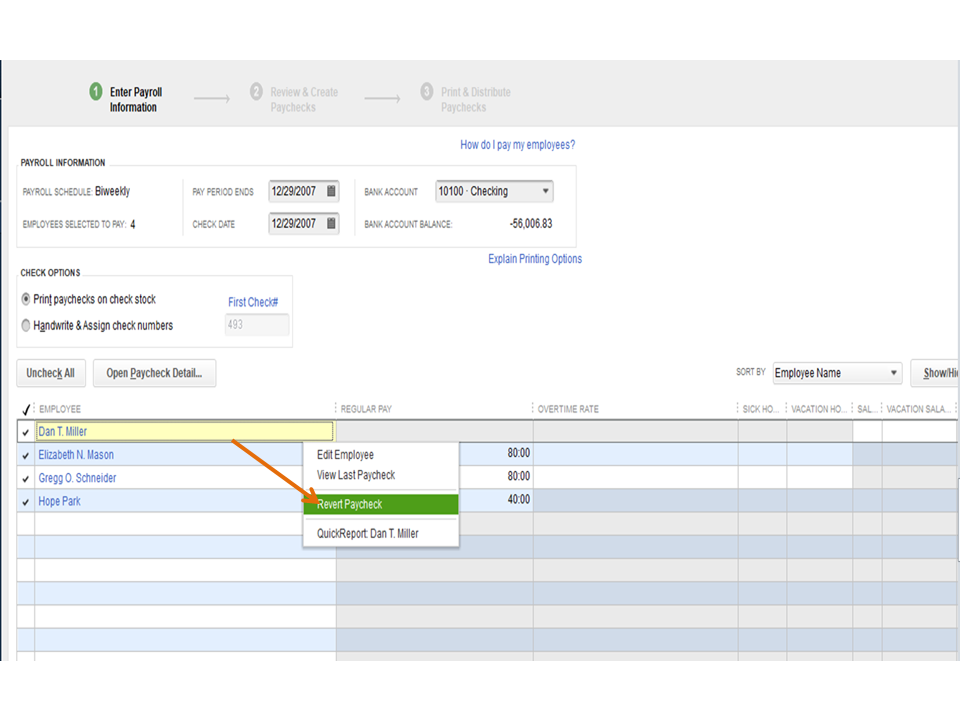

Computes federal and state tax withholding for paychecks. This number is the gross pay per pay period. Flexible hourly monthly or annual pay rates bonus or other earning items.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. 401k 125 plan county or other special deductions. No part of the tax contribution due can be deducted from a workers pay.

Return must be filed January 5 - February 28 2018 at participating offices to qualify. The PaycheckCity salary calculator will do the calculating for you. Type of federal return filed is based on.

The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. The withholding tax tables withholding formula MO W-4 Missouri Employers Tax Guide and withholding tax calculator have been updated. Eventually an employer becomes eligible for an experience rate.

Withholding Tax Per Payroll Period Missouri. Employees with multiple employers may refer to our Completing a New MO W-4 If You Have More Than One Employer example to make changes to their Missouri W-4s. Switch to Missouri hourly calculator.

Valid for 2017 personal income tax return only.

The Tax Preparation Checklist Your Accountant Wants You To Use Tax Prep Checklist Tax Preparation Tax Prep

Missouri Income Tax Rate And Brackets H R Block

The Easy Way To Do Your Taxes Without Paying Someone Else Personal Finance Tax Help Small Business Advice

Employers Can Exclude Some Veterans From Ale Calculation Affordable Bookkeeping Payroll Employment Health Care Coverage Ale

How To Pay Your Nanny S Taxes Yourself Nanny Tax Payroll Template Nanny Payroll

Solved Payroll Taxes Not Deducted Correctly

403 B Plan Vs Roth Ira Infographic Inside Your Ira Roth Ira Investing For Retirement Roth

How To Start A 501c6 Ultimate Guide To Registering A 501c6 Nonprofit Tax Exemption Non Profit Nonprofit Startup

4th Of July Worksheets Mouth Healthy Kids Online Learning Healthy Kids Kids

Loan Amortization With Microsoft Excel Tvmcalcs Com Amortization Schedule Schedule Templates Schedule Template

The Complete Guide To The Australian Taxation Office And What You Need To Know Before Filing Taxes Filing Taxes Tax Reduction Tax Services

Pin On Canada Paystub Maker Payslip Paycheck

Check Out This Kahoot Called Budgeting And Financial Management On Getkahoot Play It Now Mortgage Payoff Pay Off Mortgage Early Saving For Retirement

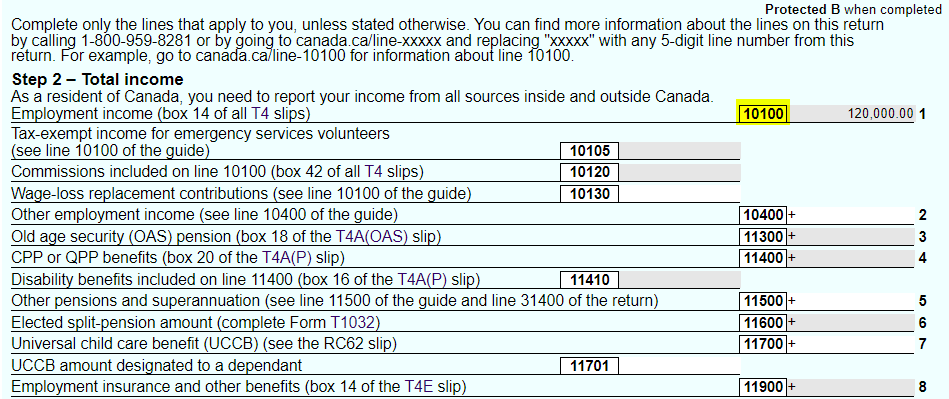

What Is Line 10100 Or 101 On Your Tax Return Loans Canada

Proof That Birth Certificates Are Traded On Nyse Stock Exchange Birth Certificate Stock Exchange Fake Birth Certificate

5 Fake Payroll Stubs Simple Salary Slip Personal Loans Online Personal Loans Financial Information

403 B Plan Vs Roth Ira Infographic Inside Your Ira Roth Ira Investing For Retirement Roth